Gold stocks or gold bullion: Gold ETFs

Etcs are essentially the commodity equivalent of exchange-traded funds (etfs) – they are traded like shares on investment platforms and are generally much cheaper than buying physical gold. You tend to hold them in a stocks and shares isa.

Although there’s no need to pay for storage and insurance, you will need to pay a fee to buy or sell using a platform. The etc tracks the price of gold, either based on gold it stores in a vault or based on buying gold-related

products

(which can be riskier).

Although there’s no need to pay for storage and insurance, you will need to pay a fee to buy or sell using a platform. The etc tracks the price of gold, either based on gold it stores in a vault or based on buying gold-related

products

(which can be riskier).

Investing in gold mutual funds means you own shares in multiple gold-related assets, like many companies that mine or process gold, but you don’t own the actual gold or individual stocks yourself. Gold exchange-traded funds or mutual funds have more liquidity than owning physical gold and offer a level of diversification that a single stock does not. Etfs and mutual funds also come with certain legal protections. Be aware that some funds will have management fees. Learn more about etfs and mutual funds.

Although gold has been a store of value and a medium of exchange for centuries, recent economic uncertainty has left some investors rushing back to the og of precious metals. And it’s not just hardcore spandau ballet fans either. This renewed interest has shone a light on modern gold miners , with investors searching high and low for the best gold mining stocks on the market. In the uk, the share price of gold stocks, alongside the physical gold spot price, might be carefully watched by investors hoping for long-term gains or a potential short-term hedge against volatility. But is gold actually a safe haven asset? is gold an inflation hedge ? is it better to buy gold, or stock in a gold miner? are gold etfs a good investment? let’s get into it.

Anything can happen when markets are hit with extraordinary volatility. But regardless of what stocks might do, is it wise to be without a meaningful amount of physical gold and silver in light of all the risks we face today? i don’t think so. Perhaps the ideal solution is to have a stash of cash ready to deploy if we get another big decline in precious metals — but to also have a stash of bullion already set aside in case the next crisis sends gold off to the races. Browse our catalog follow jeff on twitter @thegoldadvisor.

Has Gold Been a Good Investment Over the Long Term?

Gold has long been one of the most prized metals on earth. It has played a major role in the economies of many countries, and used to be used as a form of currency. Although this is no longer the case, gold can still be a reliable, long-term investment and may be a valuable portfolio addition, particularly in times of economic downturn.

We've outlined the main advantages:.

We've outlined the main advantages:.

If you’re seeking an income from your investments, gold won’t pay you any interest, nor will it provide you with any dividends. Instead the hope is that gold will provide you with long-term capital returns, although as with other forms of investment, there are no guarantees and you could get back less than you put in.

The pandemic set in motion a tsunami of unprecedented events that changed the social, political and economic landscape of the world. The recovery is ongoing even while the threat is still imminent and the long-term effects of lockdowns, fiscal stimulus, furlough and a raft of economic safety measures is still unknown. Inflation is rampant and there may yet be more financial shocks in the market. With all of this mind, it makes sense to invest in a commodity that has demonstrated consistency over recent years and is projected to do so in the coming ones. Both gold and shares have their respective advantages and drawbacks, but in times like these when the future and the economy are uncertain, gold is the clear winner when it comes to long term investment.

The choice of investing in precious metals vs. Stocks is ultimately a personal one that you’ll have to make depending on your investing goals. While we’ve seen that gold can outperform stocks over the long run, there are certainly periods of time during which stocks can outperform gold. The bull market of 1982-2000 was one of those times, as was the stock market run of 2016-2018. With judicious planning and a little bit of lucky timing, investors can adjust their investment portfolios to take advantage of the gains that can be made from investing in both stocks and gold.

Gold vs. Stocks and Bonds

Diversification is one of the most important things to get right when managing a portfolio. When done properly, diversification can increase the rate of return you can expect from a given amount of total risk, or decrease the risk required to achieve a given rate of return. When some assets are rising in price, usually other ones are declining, which creates opportunities for contrarian investors to cycle capital into those undervalued assets. And in my opinion, having a small allocation to precious metals like gold and silver is a useful part of diversification, because they are partially uncorrelated with stocks and bonds and have different and unique risks and opportunities.

Gold fell for the sixth straight month in september, a losing streak we haven’t seen since 2018, as the federal reserve undertakes its most aggressive rate hike cycle in recent memory. The central bank has added close to 250 basis points (bps) so far this year in its fight against inflation, and many asset classes, from stocks to bonds to bitcoin, have the bruises to show for it. Gold is no exception, though it’s managed to hold up better than most investments, despite higher rates and an historically strong dollar, the precious metal’s longtime adversary. As of friday, the s&p 500 has lost 22% for the year, while gold is down only 7%.

When economic times get tough or international conflicts such as the russia-ukraine war throw the markets for a loop, investors often turn to gold as a safe haven. With inflation spiking and the stock market trading well below its highs, some investors are looking for a safe asset that has a proven track record of gains, and that’s gold. Investors like gold for many reasons, and it has attributes that make the commodity a good counterpoint to traditional securities such as stocks and bonds. They perceive gold as a store of value, even though it’s an asset that doesn’t produce cash flow.

What is a gold etf (exchange traded fund)? eft stands for exchange traded fund and is a security that tracks an index, commodity, or basket of assets such as stocks and bonds. Etfs can be traded like stocks on a stock exchange. There are many types of etfs, but the most common are stock etfs, which hold shares in different companies. Why invest in gold etfs? gold etfs are a convenient way to invest in gold because they provide liquidity and diversification. Liquidity means you can buy and sell shares of a gold etf like any other stock on an exchange.

What is the average return on gold investments?

This conservative investment offers the highest short-term returns. One-ounce gold bullion coins minted by the u. S mint move dollar-for-dollar with the spot gold price. Investment grade gold, also known as “bullion with muscle” offers the same benefits as bullion but with higher profit potential. This graph shows a 2001 investment in gold bullion had grown 331% as of 12/31/16. That same investment in s&p 500 stocks grew only 72% over the same period of time. If you can’t hold it, you don’t own it. To capitalize fully on the portfolio diversification strengths of alternative investments, make sure your assets are tangible.

As the us dollar has slumped gold investment has outstripped the gains in all major world currencies. In the five years to 2008 buying euros to defend against the dollar's decline has returned 47%. Gold investment, on the other hand, has returned 131%. British, australian, south african and indian citizens undertaking gold investments in 2007 all enjoyed the gold price reaching record new all-time highs.

While there is no direct yes or no response to know whether gold or the s&p 500 index is better, there is an answer to know which investment strategy is best for you. The experts at noble gold investments are here to guide you on how to purchase gold coins, silver coins, and other precious metals in your ira. Our team offers a free gold investment guide and one-on-one investment planning assistance to help you maximize your return. Plan wisely for retirement and open an account with noble gold investments today; there’s no time like the present to begin planning for your future.

Coming back to the example of our boy. He bought into the nifty50 index and gold etf in may’2007. Considering that he has held on to his investments till today, his average return (cagr) would be as shown below.

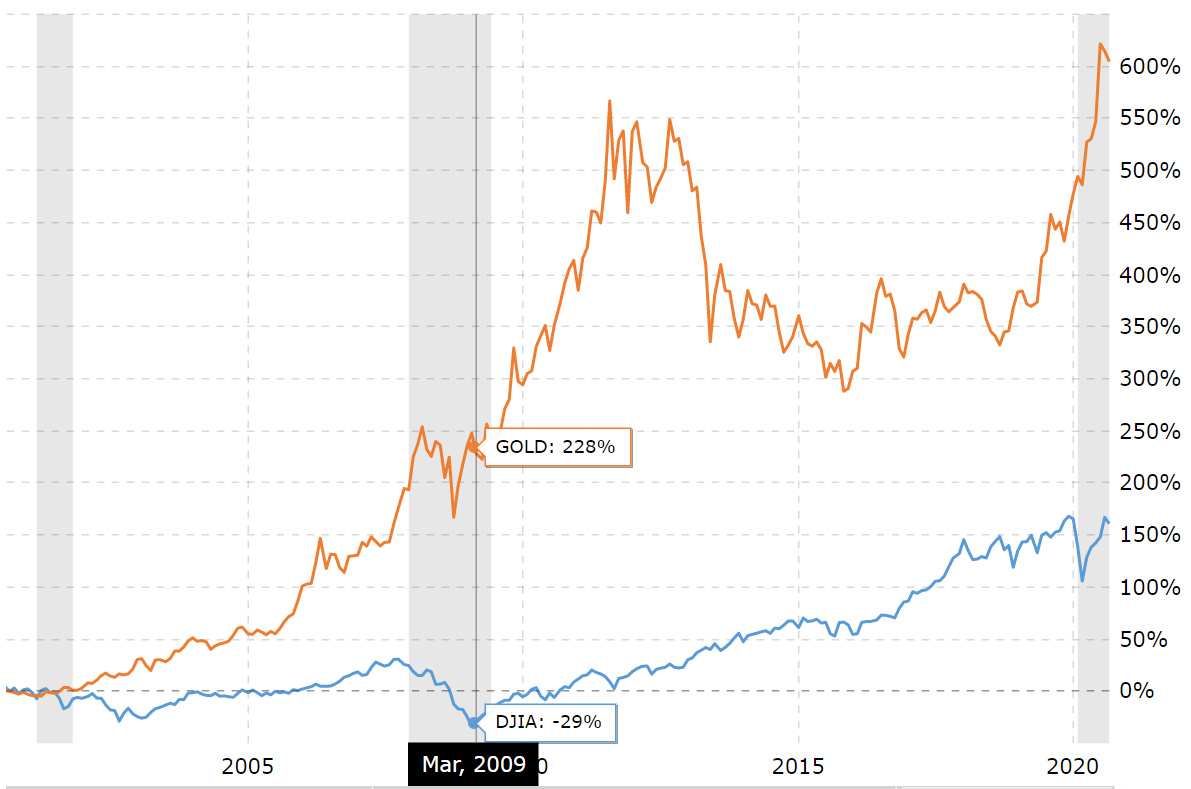

Gold Price vs Stock Market - 100 Year Chart

Like stocks, the gold market has lately been driven by 3 key factors: soaring inflation central banks raising interest rates the war in ukraine but under such circumstances, contrary to stocks, the gold price went up, playing its part as a safe haven and a hedge against risks: in february, the gold price was mostly surging on inflation and geopolitical concerns. Days before russia’s invasion of ukraine, the spot gold price hit $1,912 per ounce, rising from its $1,800 range of the beginning of february. And it didn’t stop there. In march, gold climbed further to $2,043 per ounce, close to its all-time high, showing a rise of 13.

The power of the dow gold chart can be seen looking back, for example, two decades ago. Take a look at the relative performance situation between gold and the dow (i. E. , u. S. Stock market). In late 1999, gold’s price was in the high $200s in fiat us dollars. The dow was topping near the latter phase of the dotcom bubble mania phase. After gold’s 2001 breakout, it continued to outperform in the dow gold ratio in multiple legs of advance—for the next decade. And this wasn’t merely a loss of stock valuations versus gold, but a massive gold price advancement coincident with gold’s price peak going from the $200s to above $1900 oz in fiat federal reserve notes by 2011.

Which was the best investment in the past 30, 50, 80, or 100 years? this chart compares the performance of the s&p 500, the dow jones, gold, and silver. The dow jones is a stock index that includes 30 large publicly traded companies based in the united states. It is one of the oldest and most-watched indices in the world. The s&p 500 consists of 500 large us companies, it is capitalization-weighted , and it captures approximately 80% of available market capitalization. For these reasons it is more representative of the us stock market than the dow jones. Both versions of these indices are price indices in contrast to total return indices.

The value of gold tends to rise during recessions or other challenging times. This is because when the stock market or other securities start to see volatility or drop in value, investors turn to gold for safety. As more and more flock to it, its supply goes down, and the price goes up. Case in point: at the height of the great recession, gold's value jumped nearly 13% in a single year, according to the bureau of labor statistics.

Comments

Post a Comment